Deeper insight into the insurance

industry.

Follow for more

Open-Enrollment - Do you need to wait?

“The self-employed often are overcharged and underserved when looking to provide health benefits to their families or business. We look to empower our clients to leverage the health marketplace to its fullest extent.”

- Nathan Baughman

Introduction:

In this article, we'll delve into the intricacies of open enrollment and discuss why it is a crucial period for selecting health insurance coverage. At Baughman Insurance Group, we specialize in helping self-employed and self-insured people and families and without employer-sponsored plans find the right health insurance options. So, let's get started!

Open Enrollment: Do You Need to Wait? 🤔

What is Open Enrollment?

Open enrollment refers to a specific period, typically from November to December (recently extended until January 19th), during which individuals can sign up for health insurance. It is essential to understand that open enrollment only applies to plans on the healthcare marketplace (Obamacare, Healthcare.gov, Pennie.com, etc.). These plans generally offer guaranteed issue coverage, meaning that they cannot deny you health insurance based on any pre-existing conditions or previous medical diagnoses. This inclusivity ensures access to health insurance for everyone, regardless of their health care scenario.

Purpose of Open Enrollment

The primary purpose behind open enrollment is to provide individuals with pre-existing conditions or previous medical diagnoses the opportunity to obtain health insurance. The other primary reason for Open enrollment is to eliminate adverse selection which would increase the risk pool for the members and increase costs.

Without open enrollment, people could wait until they are sick or injured to seek health insurance coverage. This would strain the system and make it challenging for insurers to provide comprehensive coverage to those in need. Open enrollment creates a fair and balanced system by setting a designated period for enrollment, preventing people from cherry-picking insurance only when they require it urgently.

Guaranteed Issue Coverage

Let me say this again...Regardless of your health condition, you will not be denied health insurance. This provision is especially beneficial for individuals managing moderate to severe medical conditions.

The negatives come out in that by taking more high risk members, the price, deductibles, copays and out of pocket costs have consistently increased year over year to keep up with medical pricing for services. For those that don't have to manage more sever medical conditions, you can apply for coverage based on your current health history or lack of health history to secure lower rates through lower risk groups.

Alternative Plans

What if you need coverage and you are outside of open enrollment? While open enrollment is the primary opportunity to enroll in long-term health insurance plans, you may still have coverage gaps throughout the year. In such situations, short-term health insurance plans can serve as a useful alternative. These plans are designed to bridge temporary gaps in coverage and typically offer limited benefits for a specified duration.

Short-term plans are particularly beneficial for those between jobs or waiting for open enrollment to begin. However, it's essential to note that these plans may have restrictions on coverage, including pre-existing condition limitations and maximum benefits allowed. Therefore, it's crucial to carefully review the policy details before enrolling in a short-term plan and typically should not exceed 3 - 6 months if possible.

Medically Underwritten Plans

Another alternative to consider during open enrollment are direct-to-carrier or medically underwritten plans. These are private insurance options that you can explore outside of the traditional open enrollment period. Unlike plans subject to open enrollment, these plans may have underwriting requirements, meaning your eligibility for coverage may depend on certain factors such as your health history.

Direct-to-carrier plans are a proactive approach to coverage for individuals who want to extend their health insurance beyond open enrollment, secure lower rates they can qualify for, and lock in their plan benefits such as deductibles and out of pocket expense. While they may come with additional underwriting steps, they can provide tailored coverage and benefits to suit your specific needs. Confirm that your plan is guaranteed renewable so you know that you do not need to reapply and cannot be removed from the plan following a major medical scenario.

How to Navigate Open Enrollment

To make the most of the open enrollment period, keep these tips in mind:

1. Research and compare available plans: Take the time to research and compare the insurance plans available to you during open enrollment. Consider factors like coverage options, deductibles, premiums, and provider networks to find the plan that best aligns with your needs.

2. Assess your healthcare needs: Understand your healthcare needs and evaluate the specific benefits offered by each plan. Are prescription drugs covered? Does the plan include preventive care? Make sure the plan you choose provides adequate coverage for your unique requirements.

3. Consider your budget: Evaluate the cost of premiums, deductibles, and out-of-pocket expenses associated with each plan. Ensure the selected plan fits within your financial capabilities without sacrificing necessary coverage.

4. Seek expert advice: If you find navigating the world of health insurance overwhelming, don't hesitate to seek expert advice. Insurance brokers, like myself, specialize in guiding individuals through their options, ensuring they select the most suitable plans for their needs.

By following these steps, you can navigate open enrollment with confidence and select a health insurance plan that provides the necessary coverage and benefits.

Conclusion

Open enrollment is a critical period for securing health insurance coverage, especially for those who are self-insured or do not have access to employer-sponsored plans. The guarantee of coverage regardless of pre-existing conditions or medical history ensures equal access to essential healthcare services for everyone.

During open enrollment, carefully consider your options, including guaranteed issue plans, medically underwritten, and even possibly a short-term option if employer benefits are around the corner. Assess your healthcare needs and budget while seeking expert advice if necessary. By doing so, you can make an informed decision and select the most suitable health insurance plan that meets your unique requirements.

Remember, at Baughman Insurance Group, we are here to help answer any questions you may have and guide you through your health insurance journey. Don't hesitate to reach out for assistance during open enrollment or at any other time. Together, let's secure the best possible coverage for your health and well-being.

Note: The information and suggestions provided in this blog post are for informational purposes only and should not be considered as professional advice UNTIL you have spoken with a licensed agent FIRST. Please consult with one of our, or any trusted, licensed insurance professional or broker to discuss your individual circumstances and insurance needs to best understand what you qualify for and limitations in your plan.

YOU DON'T HAVE TO WAIT FOR COVERAGE

Our video Content

updated regularly

Shorts

bite-sized content

Speak to a Live Agent

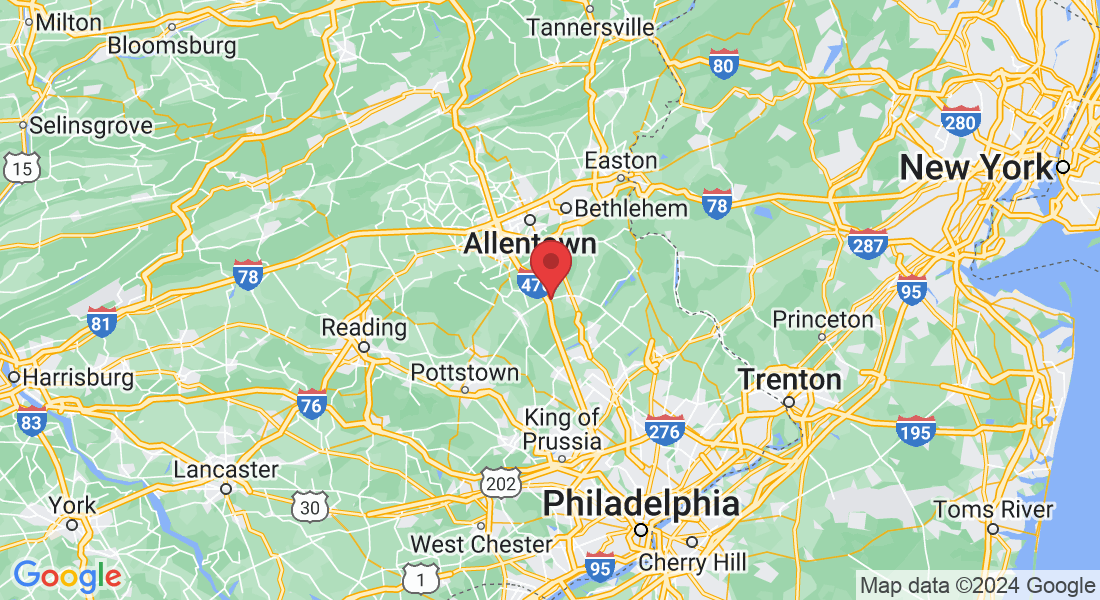

Stay up-to-date with all the plans and discounts available in your area